What Is A Pension Plan

Note that the IRS makes certain things mandatory and the plan document cannot overrule those. A pension is a residual payment that an employee receives on a regular basis after retiring from a regular job.

Pension Plans Compare Buy Best Retirement Plan Online In India

Pension Plans Compare Buy Best Retirement Plan Online In India

This means that an employee is able to determine precisely what their retirement income or benefit will be based on the age at which they retire as well as their number of years of employment with the company.

What is a pension plan. A Pension Plan is a must when planning for your retirement. For a few other things the plan document can be a. A pension plan is a type of retirement plan where an employee adds money into a fund that includes contributions by the employer.

A pension plan is fundamentally a simple product. Apply for Pension Plan today. As the economy took a downturn in the late 1990s many companies sought to provide more spendable cash by creating an underfunded pension plan where the money to cover all pensions owed currently or in the future was not available.

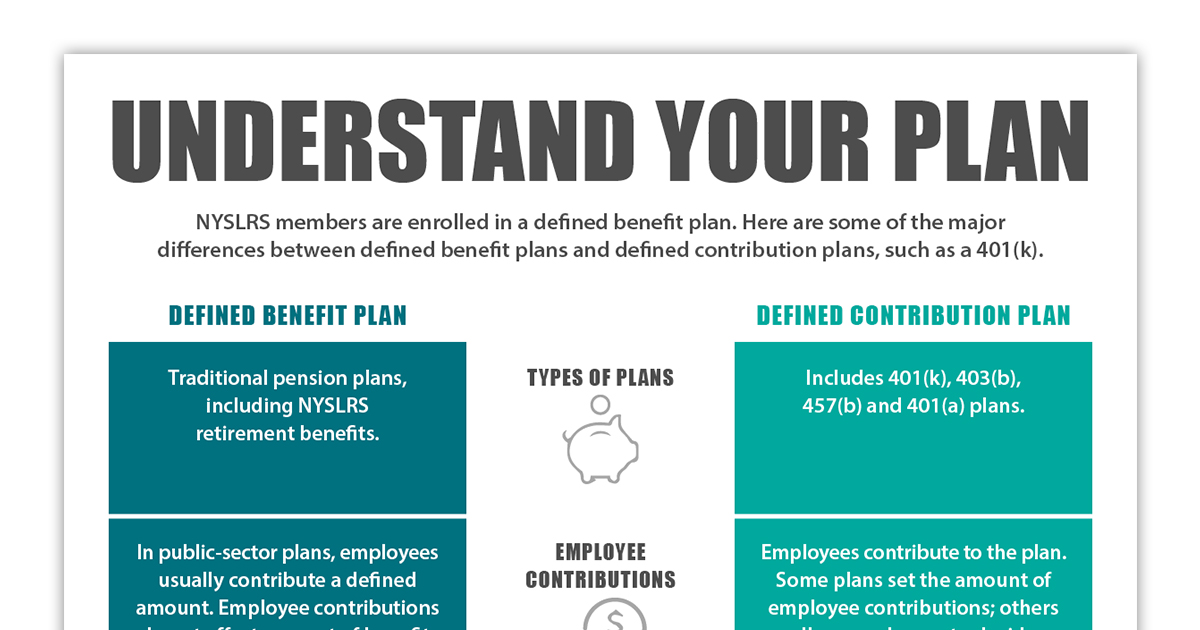

On the other hand a pension plan is commonly known as a defined-benefit plan whereby the pension plan sponsor or your employer oversees the investment management and guarantees a certain. A defined benefit plan is a type of retirement plan. A defined benefit pension is a plan which is paid out based on a formula related to age and years of service.

A pension is typically based on your years of service compensation and age at retirement. What is a pension plan. In the context of insurance the benefits provided by pension plans are often insured by insurance companies.

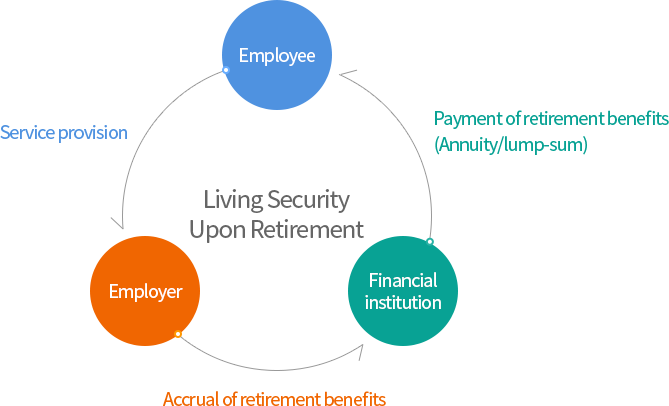

A pension plan is an employer-sponsored retirement plan that provides income during retirement or upon the termination of a workers employment. A pension guarantees you retirement income while a 401k plan depends on your own contributions and investments. The other common retirement plan is a defined contribution plan like a 401k.

There are various types of such plans available in the country offered by various companies. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. The employer pays into the fund and the employee receives a specific amount of money upon retirement.

The workers pension payments are determined by. A private pension plan is a pension plan issued by a private company as opposed to one issued by a public institution or agency. If youre lucky enough to be deciding between these two retirement.

Its different from a defined contribution plan like a 401k where employees put their own money in an employer-sponsored investment program. It outlines all the rules and regulations governing the pension plan. A pension is a retirement plan that provides a monthly income in retirement.

In the context of insurance pensions are tools that are used similarly to life insurance policies for financial planning since both can generate fixed income for retirement. A pension plan is the retirement amount which an individual gets from their insurance companies on a regular basis or in the form of a lump sum. Pensions are often used as retirement plans although it is also possible to receive a pension based on disability or other circumstances.

A pension plan is financial strategy for planning for retirement in which both an employee and an employer contribute to an account that grows over time and can be used for fixed income upon retirement. It is just a pot of cash that you and your employer can pay into - and which you get tax relief on - as a way of saving up for your retirement. Simply put a pension plan document is like the Constitution of a country.

A pension plan is a financial arrangement that allows individuals to continue receiving some type of regular income even after they are no longer active in the workforce. A pension is a defined benefit plan that an employer can offer to an employee as a fringe benefit. These can be offered in both the public and private sector though they are becoming less common in the private sector.

A Defined Benefit DB pension plan is a plan in which workers accrue pension rights during their time at a firm and upon retirement the firm pays them a benefit that is a function of that workers tenure at the firm and of their earnings. Know what is a Pension Plan its key benefits why it is important for retirement. Unlike a 401k the employer bears all of the risk and responsibility for funding the plan.

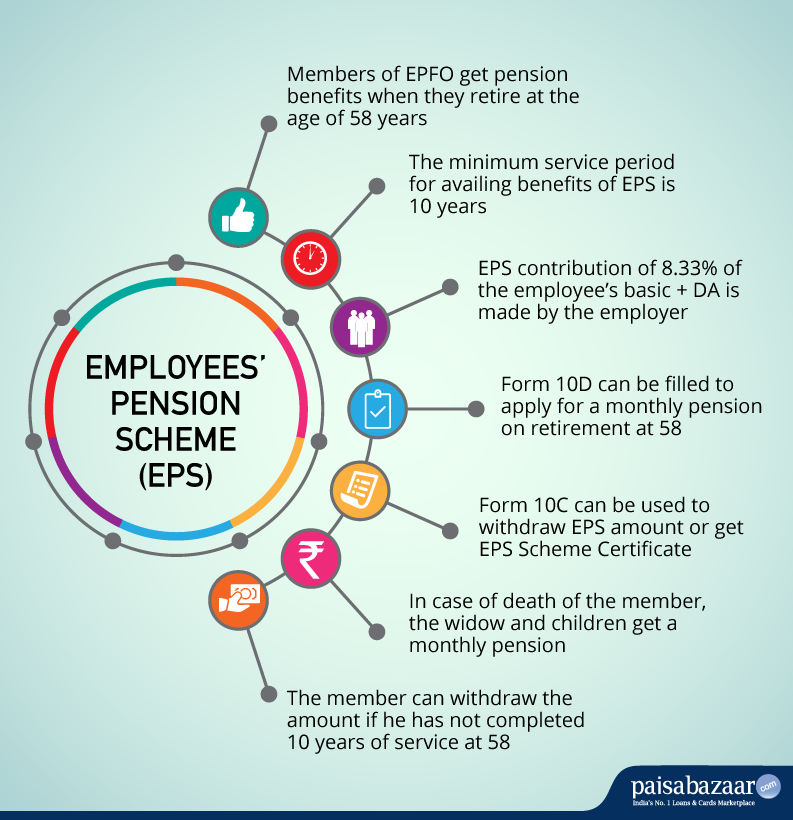

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

How Public Sector Defined Benefit Pension Plans Are Funded Reason Foundation

How Public Sector Defined Benefit Pension Plans Are Funded Reason Foundation

What Is A Cash Balance Plan Retirement Living 2021

What Is A Cash Balance Plan Retirement Living 2021

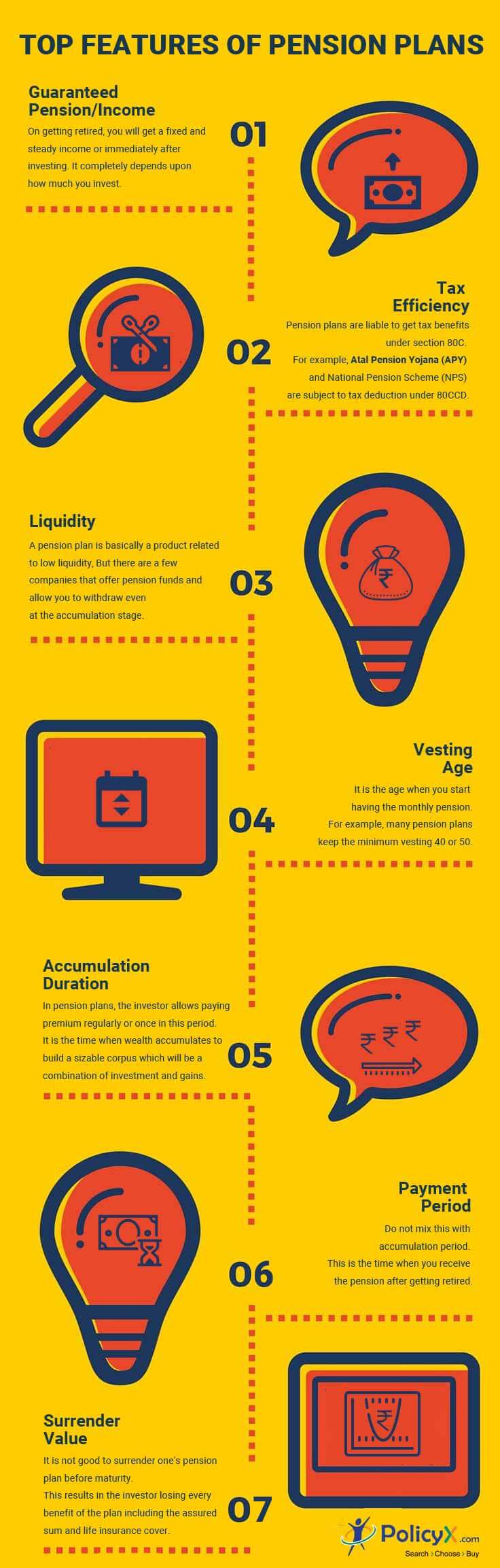

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes

Choose The Best Pension Plan For A Secure Future Ppt Download

Choose The Best Pension Plan For A Secure Future Ppt Download

Pension Plan By Jennifer Kimball What Is A Pension A Pension Is A Plan That Sends You Money After You Are Retired Or Aren T Working Anymore Pensions Ppt Download

Pension Plan By Jennifer Kimball What Is A Pension A Pension Is A Plan That Sends You Money After You Are Retired Or Aren T Working Anymore Pensions Ppt Download

What Is A Retirement Pension Plan

What Is A Retirement Pension Plan

What Is A Defined Benefit Plan New York Retirement News

What Is A Defined Benefit Plan New York Retirement News

What Is A Pension Plan And How Does It Work Gobankingrates

What Is A Pension Plan And How Does It Work Gobankingrates

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-748d66dee7454c33907bb46cc5951803.png) What Happens To Your Pension When You Leave A Company

What Happens To Your Pension When You Leave A Company

:max_bytes(150000):strip_icc()/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830.png)

Comments

Post a Comment