Fiduciary Vs Financial Advisor

If you are getting paid for advice you have a conflict. A financial planner probably has a fiduciary responsibility to put.

Facilitator Vs Advisor Professional Financial

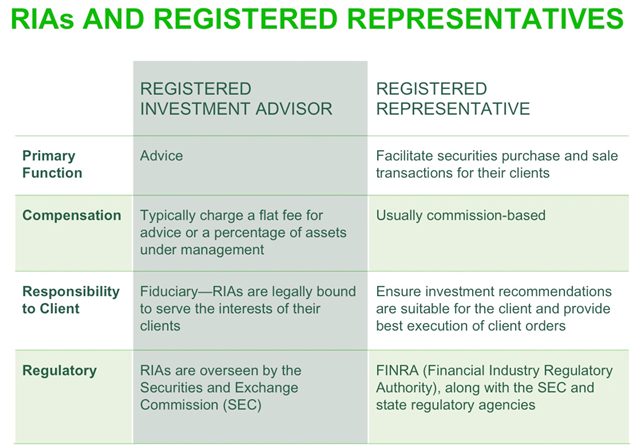

From a financial advisory perspective a fiduciary can be an individual financial advisor or an investment firm that employs the advisor you work with.

Fiduciary vs financial advisor. The number one thing you need to remember about fiduciary vs. When certain best practices are followed the result can be an Alpha in the 3 percent per year range. The advisor should offer a clear concise and logical explanation.

Theres no doubt that when a fiduciary creates a financial plan for you or gives you investment advice they. Securities and Exchange Commission and file a Form ADV. You also have a bias toward your point of view.

RIAs who promote themselves as conflict-free are not being truthful. We urge all investors to do their homework before signing on with an advisor. Securities and Exchange Commission SEC or a state securities regulator as a registered investment adivisor or are a CERTIFIED FINANCIAL PLANNER TM professional CFP they are not held to the.

Based on research analysis and testing Vanguard has concluded that yes there is a quantifiable increase in return from working with a financial advisor. Financial Advisor If youve recently started planning for retirement or youre looking to invest some of your money to help you create a more financially secure future for yourself theres a good chance that youve heard the terms fiduciary and financial advisor tossed around in conversation. An advisor who gets paid through one of the three fee models I listed above and receives a.

The biggest difference between fiduciary vs. They also should be willing and able to spell out how they work with clients and what rules apply to the advice they give. If your advisor says theyre not a fiduciary ask why.

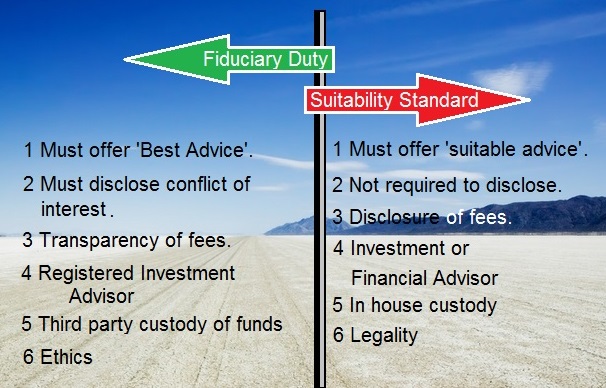

The most common difference between a fiduciary and an advisor acting under a suitability standard is the decision-making process George says. In general fiduciary financial advisors tend to have fewer conflicts of interest. Fiduciary financial advisors are required to provide their services on a fee-only or fee-based basis.

Financial advisor vs. The easiest way to find out if your advisor is a fiduciary is simply to ask. There are many things to consider when selecting a financial advisor.

Details on why in Tara. A financial adviser spelt with an e is a person who gives you actual financial advice designed to help you formulate a long-term financial strategy and bears a responsibility towards you as a client. Even though the terms are similar theres an important distinction.

While many advisors will claim to have your best interest at heart unless they operate as a fiduciary they are not held to a legal standard to do so. There are multiple solutions to client problems. Lets break it down.

Financial Advisor vs Fiduciary Advisor It is important to remember that not every financial advisor is also a fiduciary advisor. Really we mean it. Vanguard calls this advantage the Advisors Alpha.

Financial advisor and financial planner are popular titles for individuals who help consumers manage their money. In an industry largely characterized by a lack of corporate accountability and conflicts of interest we want to be the outspoken financial mavericks you can turn to for advice and straight-forward unfiltered opinions. A lot of the financial advisor versus financial planner debate has centered on if youre a fiduciary advisor or not Diehl says.

Family investment history hopes dreamsthe works. Non-fiduciary financial advisors is that the former are legally required to act in your best interest. One fiduciary advisor may have a different solution to another.

One aspect which is often overlooked or misunderstood is knowing what a financial advisors responsibility is toward you their client. Non-Fiduciary Does It Really Matter. A non-fiduciary is more concerned with what they can sell youand probably less concerned with your particular situation or needs.

This pool of advisers is extremely small but their obligation to you isnt just ethically bound but legally bound as well. According to Danya Financial advisors who are fiduciaries will want to know your history Basically they want to know EVERYthing about you. There is no way to eliminate conflicts of interest.

An advisor that is solely a Registered Investment Advisor RIA that has access and control over your financial accounts and who manages your. With a fiduciary financial advisor youll know that the person managing your money must make decisions in your best interest. Financial advisor is the standard theyre held to when advising clients.

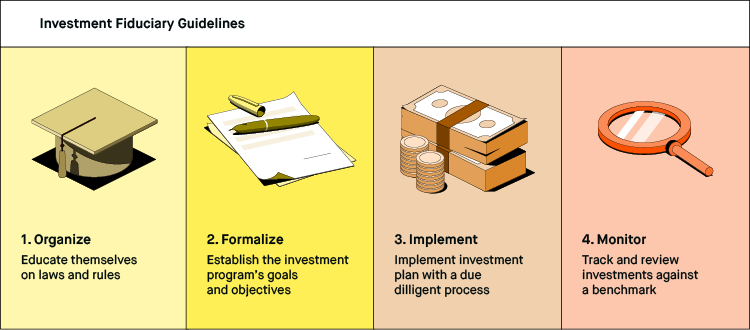

However they legally must. Before making a recommendation fiduciaries undergo. Individuals who are Registered Investment Advisors or RIAs are held to a fiduciary standard.

Most financial advisors have to sell investments that are suitable for clients but fiduciaries must act with a higher standard of care. RIAs are required to register with the US. Unless an investment advisor is registered with the US.

Difference Between The Fiduciary And Suitability Wealth

The Story And History Behind Why Hiring A Financial Advisor Is So Difficult Brownlee Wealth Management

The Story And History Behind Why Hiring A Financial Advisor Is So Difficult Brownlee Wealth Management

Willamette Financial Advisors Llc Suitability Vs Fiduciary Willamette Financial Advisors Llc

Willamette Financial Advisors Llc Suitability Vs Fiduciary Willamette Financial Advisors Llc

Fiduciary Vs Suitability Blue Line Financial Management

Fiduciary Vs Suitability Blue Line Financial Management

Fiduciary Financial Advisor What It Is Duties Obligations

Fiduciary Financial Advisor What It Is Duties Obligations

How To Select A Financial Adviser Independent Fee Only And Fiduciary Financial Specialist

Difference Between Broker And Investment Advisor Invest Walls

Difference Between Broker And Investment Advisor Invest Walls

3 Types Of Financial Advisors And Which One Might Be The Right One For You

3 Types Of Financial Advisors And Which One Might Be The Right One For You

How To Select A Financial Adviser Independent Fee Only And Fiduciary Financial Specialist

Fiduciary Vs Financial Advisor Learn About Our Financial Planning Brokerage Specialists

Fiduciary Vs Financial Advisor Learn About Our Financial Planning Brokerage Specialists

Fiduciary Vs Suitability Which Is Driving Your Investment Advice

Fiduciary Vs Suitability Which Is Driving Your Investment Advice

Why Your Investments Care If You Use A Broker Vs Fiduciary

Why Your Investments Care If You Use A Broker Vs Fiduciary

Breaking Down Financial Advisor Vs Fiduciary Advisorpedia

Breaking Down Financial Advisor Vs Fiduciary Advisorpedia

Comments

Post a Comment