Never Received W2 From Former Employer

Enter the employer ID Number EIN if you know it. These are the taxes that my former employer withheld.

Find Out How To Request A W2 From Your Previous Employer

Find Out How To Request A W2 From Your Previous Employer

At the beginning of the year you usually receive this form.

Never received w2 from former employer. If employers send the form to you be sure they have your correct address. I called the IRS and they said they never received a W-2 from my former employer. If youre unable to get your Form W-2 from your employer contact the Internal Revenue Service at 800-TAX-1040.

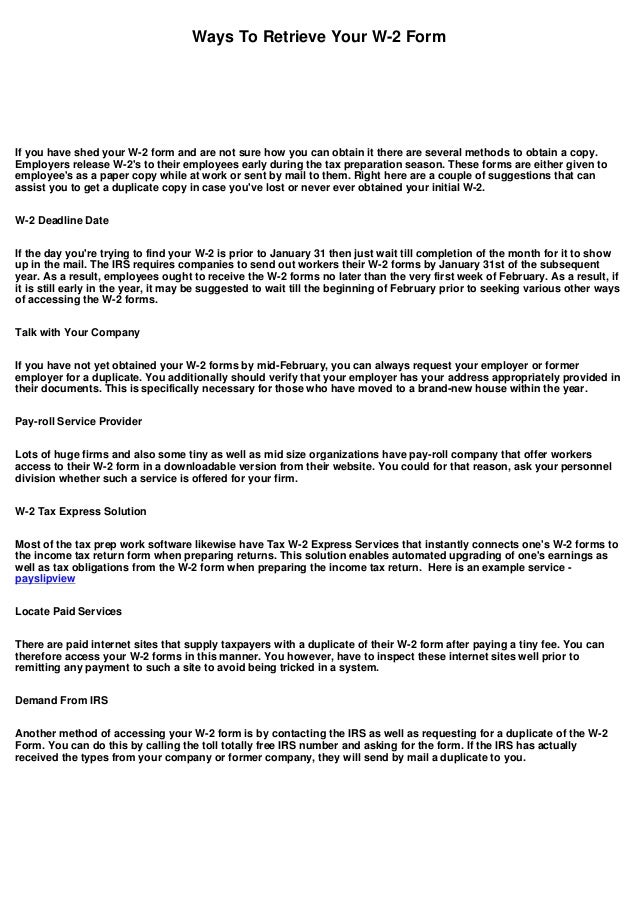

If by the end of February your Form W-2 Wage and Tax Statement has not been corrected by your employer after you attempted to have your employer or payer issue a corrected form you can request that an IRS representative initiate a Form W-2 complaint. Your name address Social Security number and phone number. Maybe they went out of business or you left on bad terms.

If it was mailed it may have been returned to the employer because of an incorrect or incomplete address. A letter will be sent to the employer requesting that they furnish a corrected Form W-2 to you within ten days. If you havent received yours by mid-February heres what you should do.

The IRS also takes notice of taxpayers who dont do the right thing so its important that you resist the urge to just go with the flow and use the erroneous W-2 particularly if doing so is advantageous to you. Form W-2 Wage and Tax Statement shows your income and the taxes withheld from your pay for the year. This is what you need to do.

You need it to file an accurate tax return. You should first ask your employer to give you a copy of your W-2. Visit the W-2 area of TurboTax and Start a W-2.

Most employers give Forms W-2 to their workers by Jan. Once you have contacted them the IRS will follow up with the employer. Youll also need this form from any former employer you worked for during the year.

If by the end of January you have not received your W-2 first contact your previous employer. I never received my W-2 for 2019 from my previous employer. Its a safe guess that the IRS will notice the discrepancy sooner or later particularly if multiple employees are involved and you dont want to.

Every employer must provide employees who received at least 600 over the year a W2 form. How to file my 2019 taxes without my W-2 form 2019. If you cannot contact a previous employer or have contacted them and still have not received your W-2 by mid-February contact the IRS to get a copy.

A According to the IRS if you have not received your w-2 Contact your employer first. Leave it blank if you dont. Get to the bottom of the situation.

Failing that you can also download Form 4506-T which has a breakdown of the W-2 information that has been reported by your employer. The IRS will contact your employer or payer and request the missing form. Why Do You Need Your W-2.

Ask your employer or former employer to send your W-2 if it has not already been sent. Enter the Employer ID Number EIN if you know it. If you havent received your form by mid-February heres what you should do.

When we ask for your W-2 info enter all the info that should be on your W-2 if you had actually received it. Have you talked to your employer about the lost W2. An IRS representative can initiate a Form W-2 PDF complaint.

Most people get their W-2 forms by the end of January. If the company you worked for has a human resources HR department call or email the HR representative to ask about the status of your W-2 and to confirm they have your correct mailing address. Anything else you want the Accountant to know before I connect you.

Your W-2 form is known as your Wage and Tax Statement It outlines the compensation you received from your employer over a year. Contact your former employer. Hello I just received a letter from the IRS saying I have to pay 3900 in taxes.

Contact your employer If you have not received your W-2 contact your employer to inquire if and when the W-2 was mailed. After contacting the employer allow a reasonable amount of time for them to resend or to issue the W-2. Call the IRS at 800 829-1040.

Would I be able to file with just my last paystub. Alternatively request Form 4852 as this allows you to estimate your wages and deductions based on the final payslip received. I did receive one but I lost it and my employer.

If however you simply omit this W-2 from your own tax return because its wrong the government receives their own copy of the W-2 and will match the records they got with the ones you sent in and they will find the omission and an auditor will be paying you a visit at which you will now have to prove that you indeed did not receive a paycheck from them and proving a negative is always hard. Ask your employer or former employer for a copy. Be sure they have your correct address.

Your employers name address and. If the employer is no longer in business or you can not reach someone you can contact IRS if you have not received it by February 14th After notifying IRS you can either continue waiting or go ahead and file Form 4852 in TurboTax. Make sure your employer has your correct address.

Sometimes situations arise that make it impossible to get your W-2 from your former employer. If your attempts to have an incorrect Form W-2 PDF corrected by your employer are unsuccessful and it is after February 15th contact the IRS toll-free at - 800 - 829 - 1040.

Still Waiting On Your W2 Form How To Get A W2 From A Former Employer Budgetpulse Blog Personal Finance Tips And News

Is Your Employer Legally Obligated To Give You Your W2 Form Quora

How To Gain Access To Your W 2 Form

How To Gain Access To Your W 2 Form

How To Get Copy Of W2 From Former Employer How

How To Get Copy Of W2 From Former Employer How

How To Get A W 2 From A Previous Employer

How To Get A W 2 From A Previous Employer

What To Do If You Don T Have Your W 2 Don T Mess With Taxes

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

/Clipboard01-779726998cf64e9085a5319a27cc25f4.jpg) Form W 2 Wage And Tax Statement Definition

Form W 2 Wage And Tax Statement Definition

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Didn T Get Your W2 Here S What To Do Now The Motley Fool

Find Out How To Request A W2 From Your Previous Employer

Find Out How To Request A W2 From Your Previous Employer

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

Haven T Received Your W 2 Take These Steps

Haven T Received Your W 2 Take These Steps

/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

Comments

Post a Comment