How To Prepare A Trial Balance

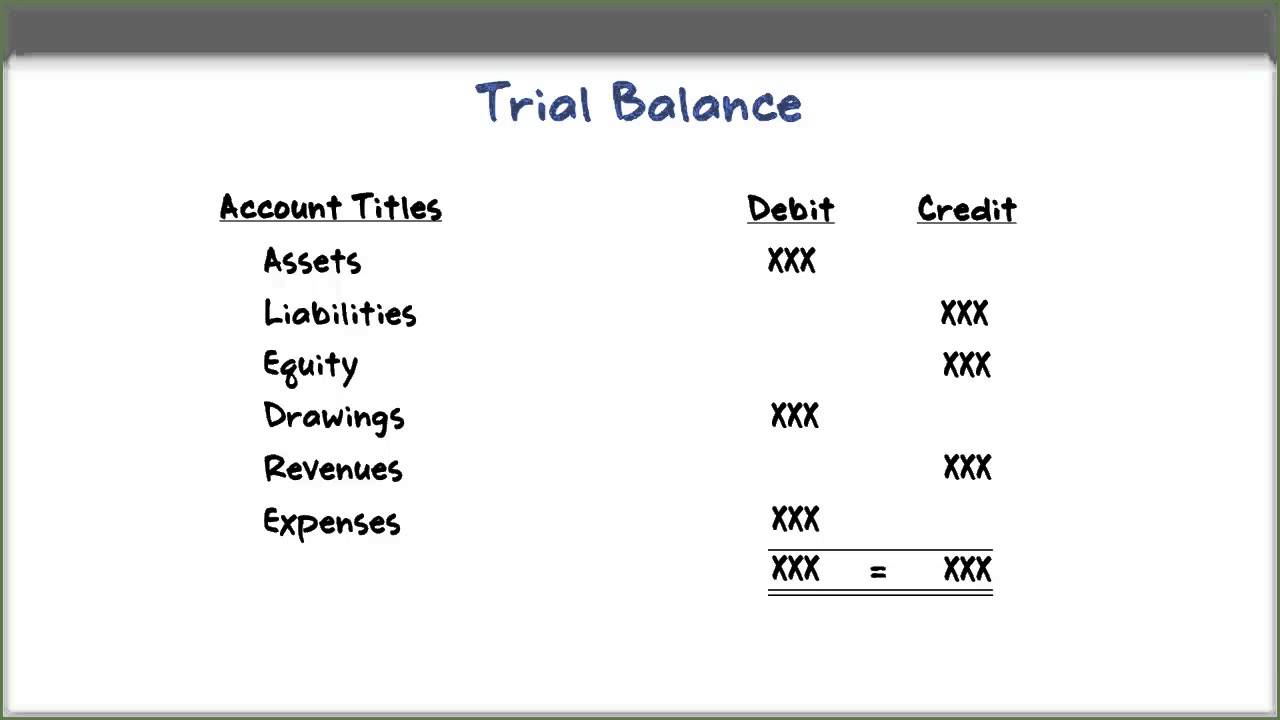

The layout of the trial balance is quite. The rules of debit and credit are as follows.

Preparation Of Trial Balance Steps In The Preparation Of Trial Balance

Preparation Of Trial Balance Steps In The Preparation Of Trial Balance

The trial balance is prepared with two different techniques.

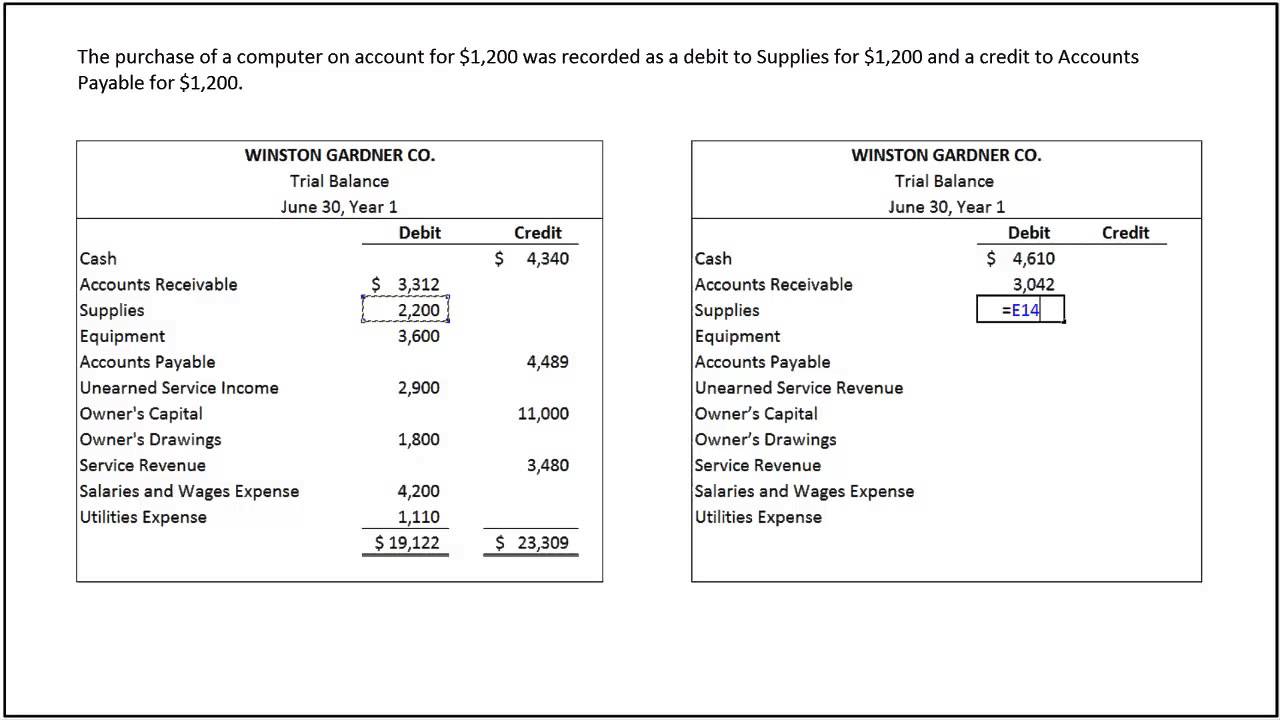

How to prepare a trial balance. How to Make a Trial Balance. The following methods can be used to prepare Trial Balance Total method. This is done to determine that debits equal credits in the recording process.

The trial balance is prepared before you make any adjusting entries. A trial balance is a list of all accounts in the general ledger that have. How to Prepare a Trial Balance.

A trial balance provides all the ending balances in a single document. Suspense account is created to agree the trial balance totals temporarily until corrections are accounted for. The trial balance is prepared after all of the current periods transactions have been journalized and posted to the general ledger and as we mentioned above before the balance sheet and income statement.

All the debit balances are recorded in. Ledger balances are posted into the trial balance. 2The names and the balances of the accounts or the totals of the credit and credit side in the ledger should be written on a separate sheet of paper to fill up the following column.

Both debit and credit totals are recorded in the trial balance. According to the Total Method the sum of debits and credits of every account is shown in the trial balance ie. On the other hand according to the Balance Method only the Net balance which is the difference between credit and debit total is.

After a company posts its day-to-day journal entries it can begin transferring that information to the trial balance columns of the 10-column worksheet. Steps to prepare trial balance Step-1 Debit and Credit Rule. In this method the total value at the end of the debit and credit columns of a companys ledger is recorded in the trial balance sheet.

So firstly every ledger account must be balanced. All Ledger Accounts are closed at the end of an accounting period. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

Trial Balance is cast and errors are identified. Prepare a worksheet with three columns. This method states the total of debit and credit amount respectively of each account are displayed in the two columns of amount against it ie one for the debit balance and another for credit balance.

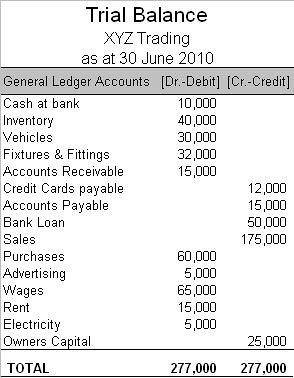

The five column sets are the trial balance adjustments adjusted trial balance income statement and the balance sheet. The trial balance is the first step toward recording and interesting your financial results. To prepare a trial balance you need to list the ledger accounts along with their respective debit or credit amounts.

The trial balance is a summary of the ending balances of the whole list of accounts or the Chart of Account in your General Ledger. For account names debit quantity. It should be prepared at the end of accounting duration possibly the end of the year month or quarter.

Debit the account when the assetsexpenses increase and the liabilitiesrevenues decrease. Producing the trial balance is the final step of data processing after that we can start producing our financial statements. There are various methods of preparing a trial balance.

Once all the monthly transactions have been analyzed journalized and posted on a continuous day-to-day basis over the accounting period a month in our example we are ready to start working on preparing a trial balance unadjusted. Run a trial balance on a regular basis at least monthly. Following Steps are involved in the preparation of a Trial Balance.

To prepare a trial balance we need the closing balances of all the ledger accounts and the cash book as well as the bank book. First we will find out the balances of the accounts and we will then classify them into assets and liabilities and will prepare a trial balance. It helps you identify any problems quickly and fix them as soon as they arise.

Do not prepare any adjusting entries yet. You are required to prepare a trial balance based upon the above transactions only. Total Method or the Gross Trial Balance Method with Template.

How To Prepare The Trial Balance. Total Method and Balance Method. 1The balances of all accounts or the total of the debit side or credit of an account for total method should be found out.

One just needs to remember these rules to record all the transactions in the books of accounts. Remember the accounting equation. Balancing is the difference between the sum of all the debit entries and the sum of all the credit entries.

The trial balance information for Printing Plus is shown previously. Preparing the trial balance should be tied to the billing cycle of the company. The main objective of preparing a trial balance is to ensure that all the journal entries and ledger balances recorded are mathematically accurate.

First of all we take all the balances from our ledgers and enter them into our trial balance table.

Preparing A Trial Balance Financial Accounting

Preparing A Trial Balance Financial Accounting

How To Prepare A Correct Trial Balance Accounting Principles Youtube

How To Prepare A Correct Trial Balance Accounting Principles Youtube

Trial Balance Example Google Search Trial Balance Trial Balance Example Part Time Business Ideas

Trial Balance Example Google Search Trial Balance Trial Balance Example Part Time Business Ideas

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Unadjusted Trial Balance Format Uses Steps And Example

Unadjusted Trial Balance Format Uses Steps And Example

How To Prepare A Trial Balance Accounting Principles Youtube

How To Prepare A Trial Balance Accounting Principles Youtube

How To Prepare A Trial Balance Business Tips Philippines

Accounting Trial Balance Example And Financial Statement Preparation Money Instructor

Unadjusted Trial Balance Preparation Format Examples

/how-to-prepare-a-trial-balance-393000-Final-e7e6e3ee832c4a3593cc611d0a73edf8.png) How To Prepare A Trial Balance For Accounting

How To Prepare A Trial Balance For Accounting

Trial Balance Archives Page 2 Of 2 Wikiaccounting

Trial Balance Archives Page 2 Of 2 Wikiaccounting

The Trial Balance Principlesofaccounting Com

The Trial Balance Principlesofaccounting Com

How To Prepare A Trial Balance

Comments

Post a Comment