Bank Reconciliation Statement Format

This document helps us to find discrepancies between our records and the bank statement. A bank reconciliation statement is a document that matches the cash balance on a companys balance sheet to the corresponding amount on its bank statement.

Bank Reconciliation Statement Explanation Format And Examples Play Accounting

Bank Reconciliation Statement Explanation Format And Examples Play Accounting

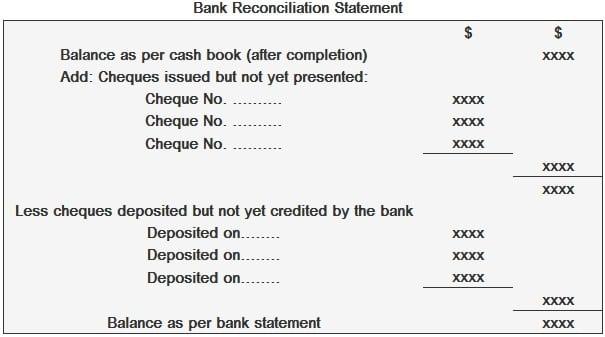

This statement reflects the outstanding cheques outstanding deposits Bank Charges etc.

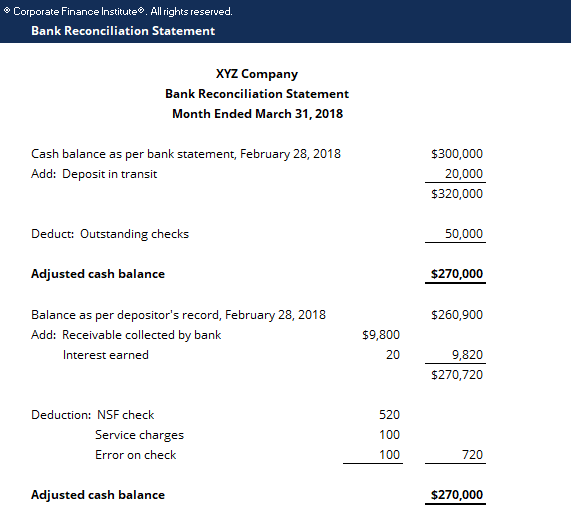

Bank reconciliation statement format. This includes 50 interest income. Bank reconciliations are completed at regular intervals to ensure that the companys cash records are correct. Cheques issued of Rs.

Prepare a bank reconciliation statement. For example if a businessman issues a cheque for say 2500 to one of his suppliers on 28 May it is quite possible that this cheque may not be presented by that supplier to his bank till say 5 June. Cash Book Bank Column for May 2018.

Bobby Berry runs a small business. The entries in this statement cease to cause difference after a few days. Therefore a bank reconciliation statement must be issued to explain the above and also to explain why there was such a difference between the companys information and the banks information.

Reconciling the two accounts helps determine if accounting changes are needed. A Bank Reconciliation Statement is a document that compares the Bank Balance as per Bank statement and the balance as per Bank Book maintained by us. This is an accessible template.

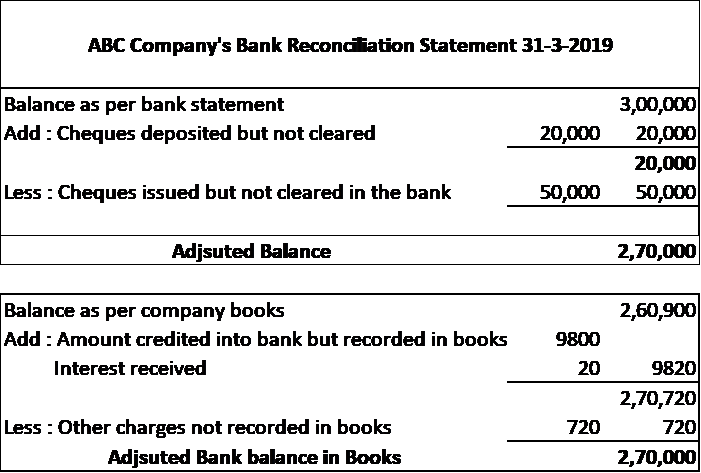

A deposit of 430 was incorrectly entered as 340 in the companys cash records. Balance as per Bank Book is 8000. The bank prepares a bank statement including cash deposits and withdrawals for a month.

Format of Bank Reconciliation Statement Bank reconciliation statement is a statement not an account. Check out this bank reconciliation template available in Excel format to help you verify and control the flow of capital that is entering and leaving your bank account. 20000 and 25000 but presented on 5 th January 2019.

He is unable to reconcile the balance on the business bank statement with that shown in his bank column of the cash book. Complete the Balance per BANK side of the bank reconciliation format. On the bank statement compare the companys list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in.

Thus different formats are used for preparing it. MODULE - II Bank Reconciliation Statement Journal and Other Subsidiary Books. Interest income earned on the companys average cash balance at bank was 123722.

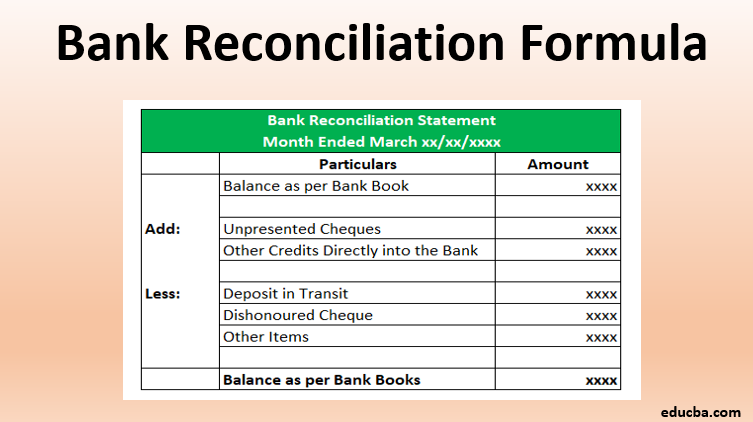

The Balance per BANK side of the bank reconciliation requires the following. Add any deposits in transit. A bank reconciliation statement is a summary of business activity that reconciles financial details.

Copies of two records are shown below. A simple format of Bank Reconciliation Statement is given as follows. This template allows the user to reconcile a bank statement with current checking account records.

Monthly bank reconciliation. It ensures that payments have been processed and money has been deposited on the same date. A transaction relating to bank has to be recorded in.

You can easily compare your own records with the ones listed on your bank account statement. An accountant prepares the reconciliation statement once a month. Amount received by the bank on the note was 550.

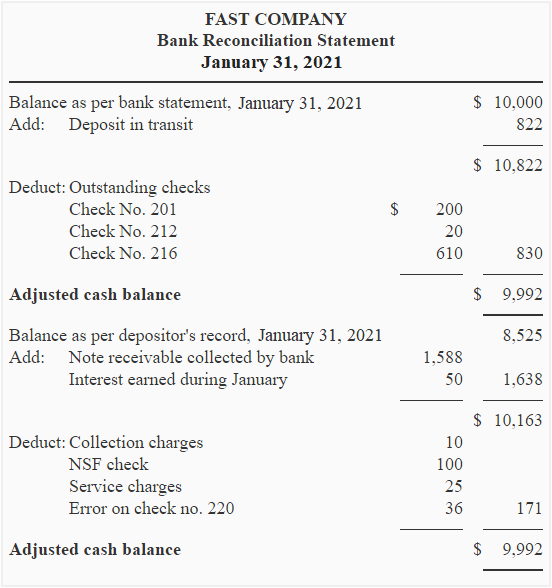

Following are the rules and format for preparing a bank reconciliation statement. Client Account Reconciliation Statement. Bank Reconciliation Formula Example 1.

Monthly Reconciliation Statement Template. A Bank Reconciliation Statement may be defined as a statement showing the items of differences between the cash Book balance and the pass book balance prepared on any day for reconciling the two balances. Enter the unadjusted balance from the bank statement or online banking information.

Bank Reconciliation Statement Template. Bank Statement Cash Reconciliation Template. It can be prepared by using various methods.

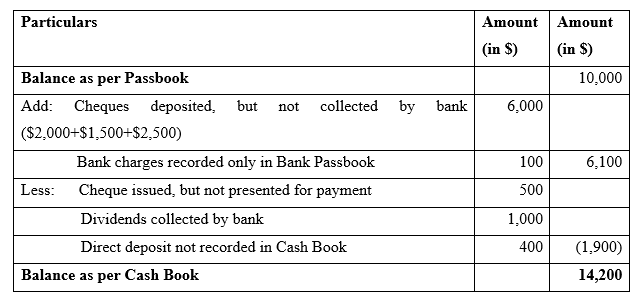

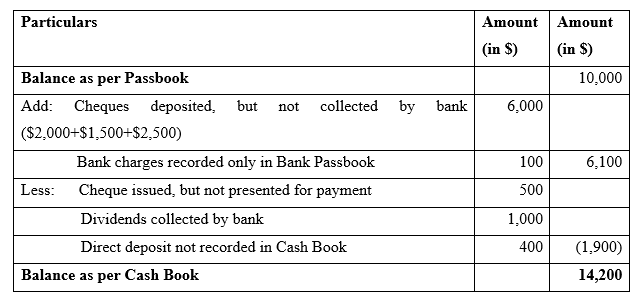

The bank collected a note receivable on behalf of the company. Using the above information the bank reconciliation statement format would look like this. A customer has deposited cash directly into the bank amounting to Rs.

From the following particulars prepare Bank Reconciliation statement for Ms XYZ and company as at 31 st December 2018. Statement of Intent Reconciliation Template. Bank Reconciliation Procedure Below are the steps to reconciliating a companys cash balance using this Bank Reconciliation Statement Template.

A Bank Reconciliation Statement is prepared at the end of the month. The bank charged a collection fee of 10.

Bank Reconciliation Statement Format Excel

Bank Reconciliation Statement Format Excel

Skip To Content Construction Jobs Mexico Beach Fl Menu From Our Blog Bank Reconciliation Statement Format Sample Posted On 24 11 2020 24 11 2020 Bank Reconciliation Statement Format Sample Related Videos Bank Reconciliations Part 1

Skip To Content Construction Jobs Mexico Beach Fl Menu From Our Blog Bank Reconciliation Statement Format Sample Posted On 24 11 2020 24 11 2020 Bank Reconciliation Statement Format Sample Related Videos Bank Reconciliations Part 1

Bank Reconciliation Definition Example Of Bank Reconciliation

Bank Reconciliation Definition Example Of Bank Reconciliation

Bank Reconciliation Statement Format Excel Excel Templates Reconciliation Resignation Letter Sample Bank

Bank Reconciliation Statement Format Excel Excel Templates Reconciliation Resignation Letter Sample Bank

Bank Reconciliation Formula Examples With Excel Template

Bank Reconciliation Formula Examples With Excel Template

Bank Reconciliation Statement Brs Format And Steps To Prepare

Bank Reconciliation Statement Brs Format And Steps To Prepare

Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example

Bank Reconciliation Example Best 4 Example Of Bank Reconciliation

Bank Reconciliation Example Best 4 Example Of Bank Reconciliation

Bank Reconciliation Statement Most Amazing Home

Bank Reconciliation Statement Most Amazing Home

Bank Reconciliation Statement Definition Explanation Example And Causes Of Difference Accounting For Management

Bank Reconciliation Statement Definition Explanation Example And Causes Of Difference Accounting For Management

Bank Reconciliation Format Most Amazing Home

Bank Reconciliation Format Most Amazing Home

Free Bank Reconciliation Template Free Download Freshbooks

Free Bank Reconciliation Template Free Download Freshbooks

Bank Reconciliation Statement Template Download Free Excel Template

Bank Reconciliation Statement Template Download Free Excel Template

What Is Bank Reconciliation Brs How To Prepare It

What Is Bank Reconciliation Brs How To Prepare It

Comments

Post a Comment