What Is Gross Payroll

For example an employee who earned 4000 pr month in gross wages from which 500 in federal taxes was withheld would count as 4000 in payroll. Gross pay includes net pay tax withholdings and deductions.

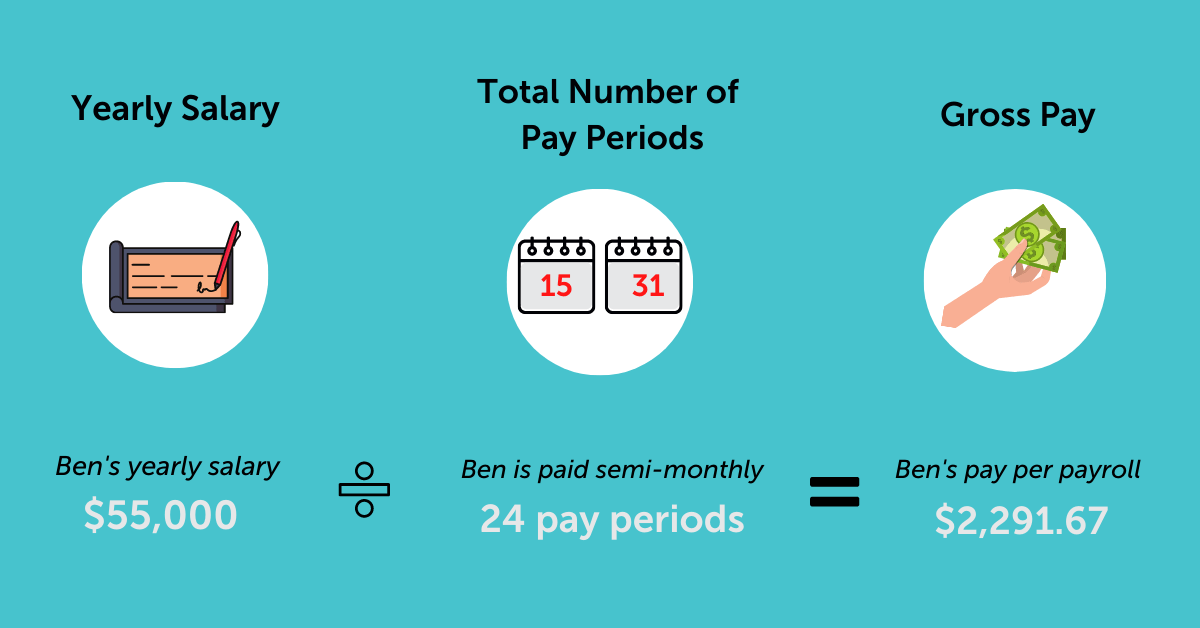

The number of pay periods per year determines how much of a workers salary you pay on each payroll date.

What is gross payroll. Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay. Usually it is the highest amount on the payslip. Gross pay is an individuals total earnings throughout a given period before any deductions are made.

Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee. The EPF in India is an employee-benefit scheme recommended by the Ministry of Labour which provides employees with an income during their retirement years. What Does Gross Payroll Mean.

Gross payroll includes all compensation paid to employees before deductions. Examples of Gross Income. Gross pay is the amount an employee receives before any deductions and taxes.

Grossing up will ensure that the employee receives that full amount even. As a result payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer but payroll costs do not include the employers share of payroll taxes. In other words whatever an employee receives from employer as part of salary constitutes gross salary.

In other words gross pay is the total amount of money an employer agrees to pay an employee as their CTC cost to company or annual salary. For example Dave joined a company as a software developer and his company agrees to pay him 240000 a year. Deductions such as mandated taxes and Medicare contributions as well as deductions made for company health insurance or retirement funds are not accounted for when gross pay is calculated.

It also includes property or services received. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. If you pay an employee hourly the pay period indicates the start and end dates for payroll.

All calculations for employee pay for instance over time withholding and deductions are based on gross pay. Once taxes are subtracted the payment will be the exact amount net that you want to give your employee. Gross wages are the starting point for payroll.

For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. Gross income also called gross pay is the individuals total pay from his or her employer before any taxes and deductions. When you calculate a tax gross-up you increase the total gross amount of compensation.

When to gross up payroll You will gross up for taxes if you promise an employee that youll give them a certain amount. The key to calculating gross payroll correctly is to determine what should be included. That is when you gross-up payroll figures.

Gross salary also called gross pay refers to pay components which an employee receives in return of his her service. What is Gross Pay. It is not limited to income received in cash.

It includes the full amount of pay before any taxes or deductions. Based on the structure of the pay slip it can be confusing to differentiate between to understand between the gross and net pay. These pay components are categorized as recurring and non recurring pay components.

Gross pay is the total amount of money that the employer pays in wages to an employee. It is the total amount of remuneration before removing taxes and other deductions such as Medicare social security insurance and contributions to pension and charity. Gross payroll is the total amount your employees earned per pay period in exchange for their labor for your company.

Gross pay can include additional income such as bonuses commissions overtime pay etc. A typical payslip will show gross pay deductions and the resulting net pay. Gross pay is the total dollar amount you pay to a worker before subtracting deductions.

According to the Internal Revenue Service This includes all income you receive in the form of money goods property and services that is not exempt from tax. In other words Gross Salary is the amount paid before deduction of taxes or deductions and is inclusive of bonuses over-time pay holiday pay etc. Gross pay is what a worker makes pre-tax or before taxes Gross pay is what a worker makes pre-tax or before taxes.

Gross pay is the amount of money an employee earns for time they worked.

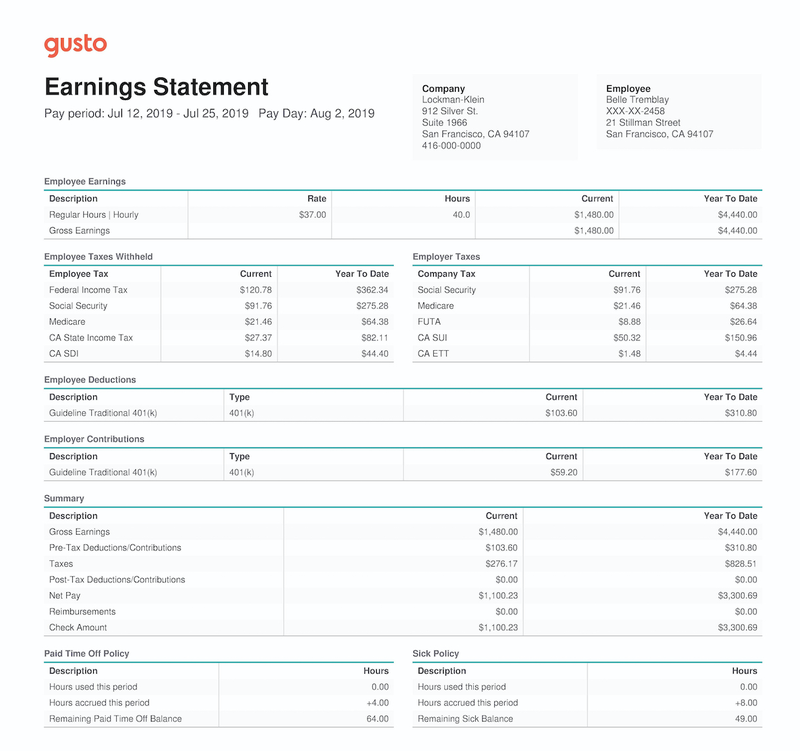

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Payroll Adjusted Gross Amounts Sage 50 Ca Payroll Sage 50 Accounting Canadian Edition Sage City Community

What Are Gross Wages Definition And Overview

What Are Gross Wages Definition And Overview

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Wages What Is It And How Do You Calculate It The Blueprint

Gross Wages What Is It And How Do You Calculate It The Blueprint

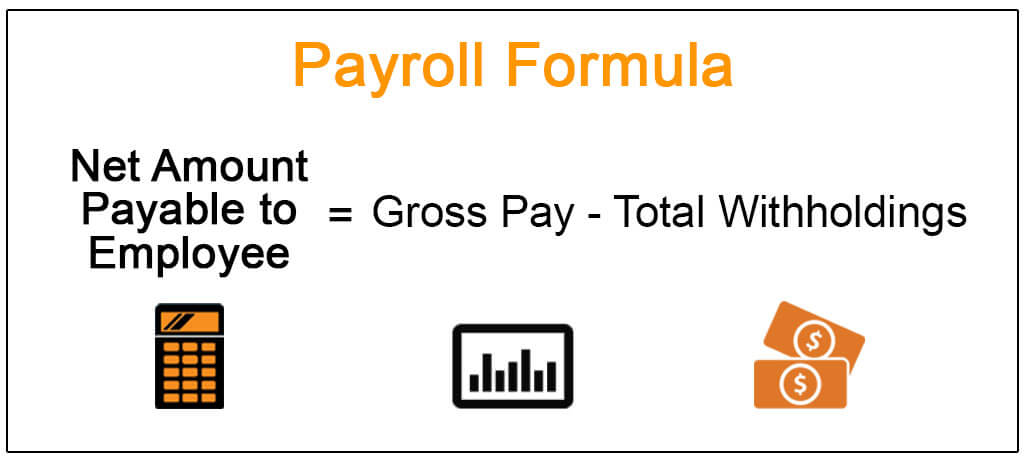

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

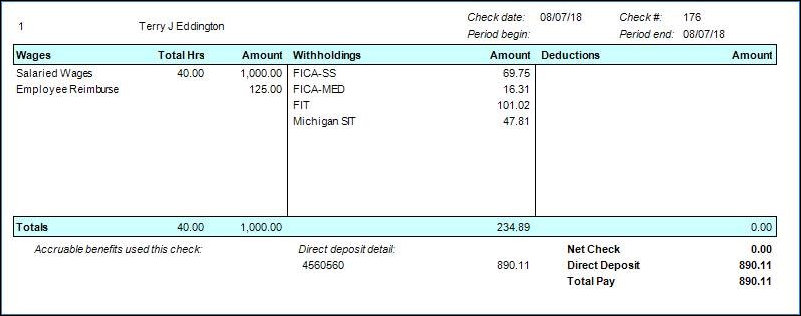

Exclude From Gross Pay Presentation Examples

Exclude From Gross Pay Presentation Examples

What Is Gross Pay With Pictures

What Is Gross Pay With Pictures

What Is Gross Salary Page 4 Line 17qq Com

What Is Gross Salary Page 4 Line 17qq Com

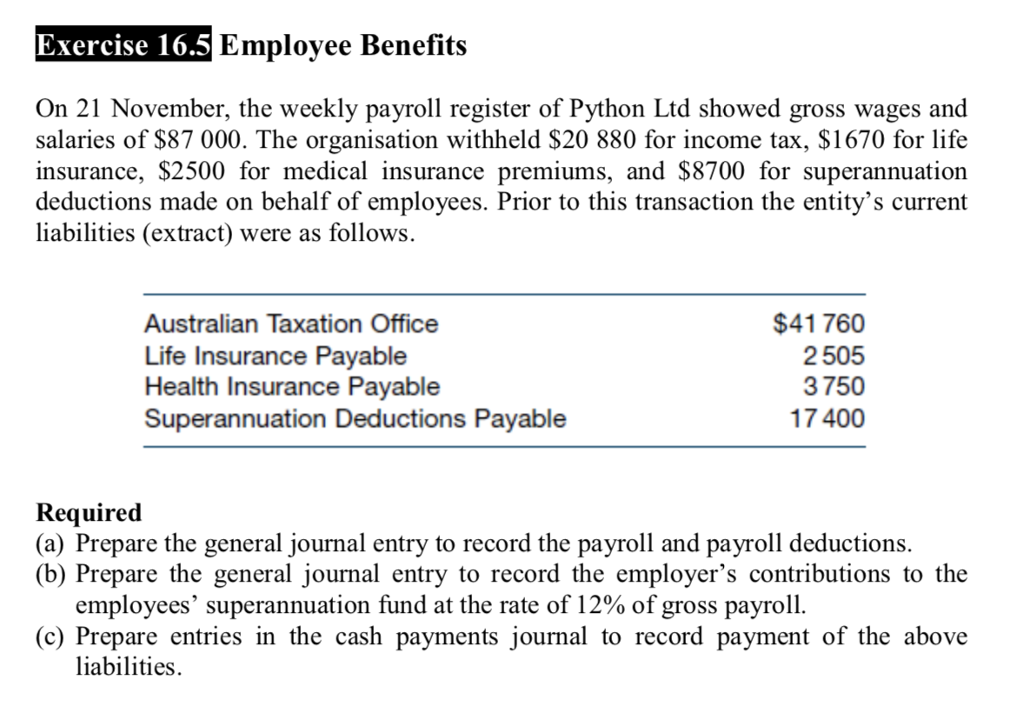

Solved Exercise 16 5 Employee Benefits On 21 November Th Chegg Com

Solved Exercise 16 5 Employee Benefits On 21 November Th Chegg Com

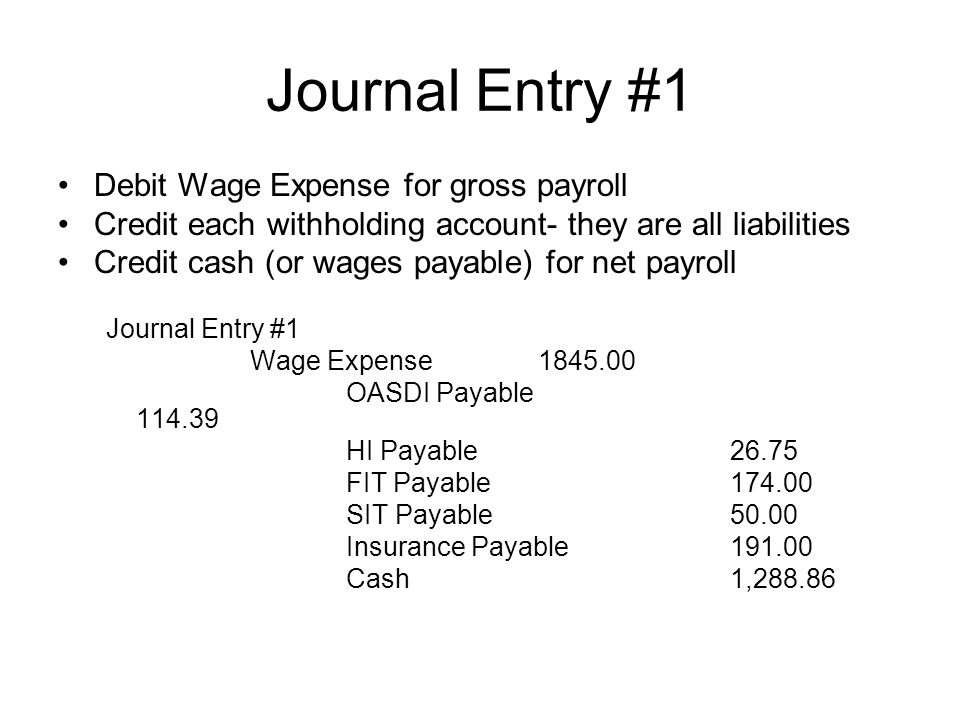

Unit 7 Analyzing Journalizing Payroll Transactions Ppt Video Online Download

Unit 7 Analyzing Journalizing Payroll Transactions Ppt Video Online Download

Gross Pay Vs Net Pay A Small Business Guide The Blueprint

Gross Pay Vs Net Pay A Small Business Guide The Blueprint

Gross Pay Vs Net Pay What S The Difference Aps Payroll

Gross Pay Vs Net Pay What S The Difference Aps Payroll

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)

Comments

Post a Comment